Succentrix Can Help You Start an Accounting Practice and Ensure Long-Term Success

Succentrix Can Help You Start an Accounting Practice and Ensure Long-Term Success

Blog Article

Key Factors to Consider When Choosing the Right Accountancy Method

Choosing the suitable accountancy technique is an essential choice that can significantly affect your monetary health and general company success. As you think about these elements, it's important to additionally reflect on the importance of customer evaluations and the firm's reputation.

Know-how and Qualifications

In the realm of accounting, knowledge and qualifications serve as the cornerstone for effective economic monitoring. When choosing an audit practice, it is essential to take into consideration the credentials of the professionals included.

In addition, specialization within the accountancy area can significantly impact the top quality of solutions provided. Some professionals focus on locations such as tax obligation preparation, bookkeeping, or forensic audit, which can give an extra extensive understanding of specific customer requirements. Furthermore, sector experience is important; accountants with a tested record in your particular sector will certainly be a lot more adept at navigating the one-of-a-kind monetary difficulties you may face.

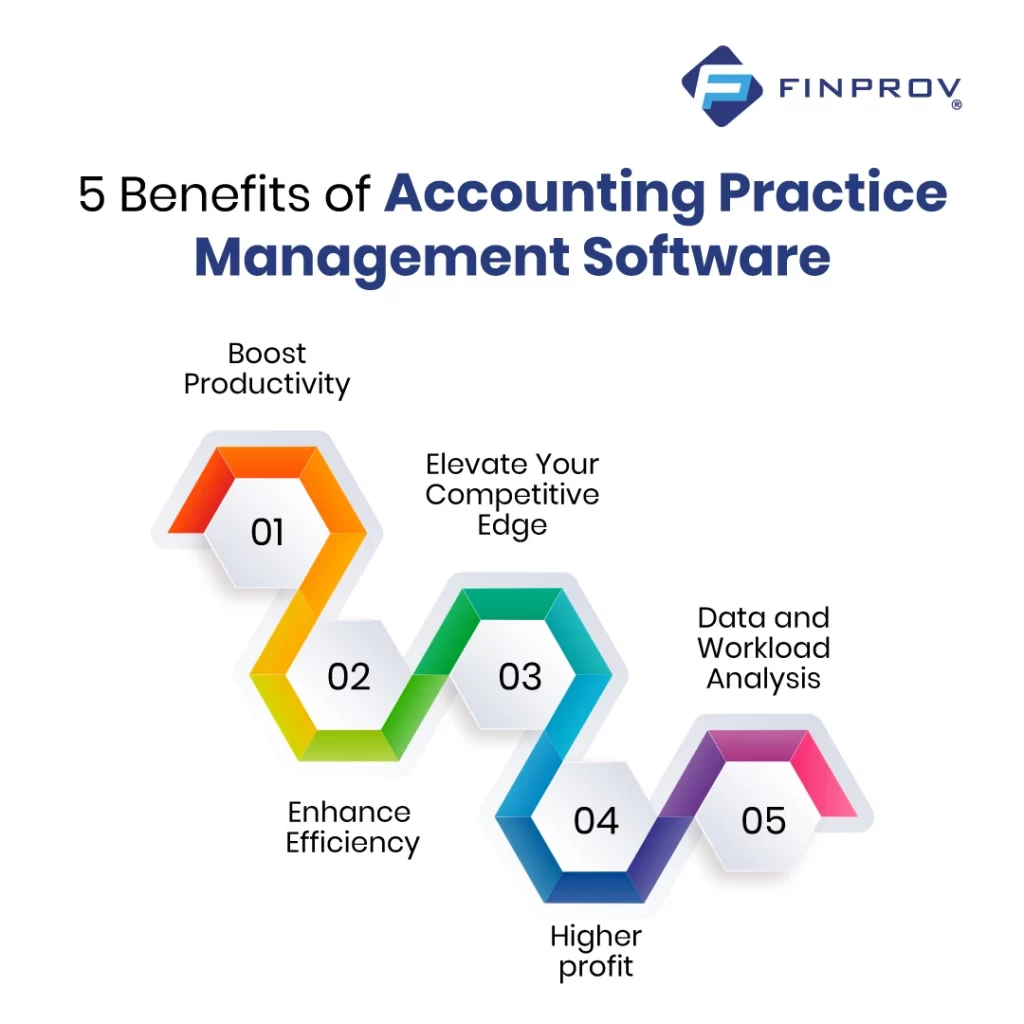

Last but not least, innovation proficiency plays an essential duty in contemporary audit methods. With the boosting reliance on audit software program and economic analytics, ensuring that the method employs experts that are proficient with these devices can improve precision and efficiency in economic reporting. Succentrix can help you start an accounting practice. Picking a company with the best experience and certifications will inevitably result in sound economic decision-making

Array of Solutions

Services, in specific, need to think about companies that use customized solutions appropriate to their sector. A practice experienced in dealing with the intricacies of production or non-profit sectors can offer insights and services that generic companies might neglect. Added solutions such as payroll administration, service valuation, and succession planning can be very useful as companies grow and develop.

Additionally, ensure that the audit practice stays upgraded with the latest laws and technological advancements, as this can substantially boost the quality of service provided. Eventually, a firm that supplies a vast array of services is much better positioned to act as a long-lasting companion, efficient in adjusting its offerings to match your changing economic landscape. This flexibility can contribute substantially to your organization's total success and financial health.

Interaction and Accessibility

Efficient communication and access are critical variables when selecting an audit method, as they directly affect the quality of the client-firm connection. A firm that prioritizes clear and open interaction promotes trust and guarantees that customers feel valued and recognized. It is important to assess exactly how a technique communicates important details, whether with regular updates, prompt feedbacks to queries, or the ability to describe complicated monetary principles in nonprofessional's terms.

Availability is similarly crucial; customers should feel great that they can reach their accountants when required. This includes taking into consideration the company's operating hours, accessibility for examinations, and responsiveness with various networks, such as phone, e-mail, or in-person conferences.

In addition, modern technology plays a critical role in improving interaction and accessibility. A method that leverages modern communication tools, such as safe and secure customer sites or mobile applications, can facilitate details sharing and make it less complicated for clients to access their financial information anytime, anywhere. Eventually, you can try here a firm that masters interaction and accessibility will not only simplify the bookkeeping process but likewise build a solid, enduring collaboration with its customers, guaranteeing their needs are fulfilled efficiently.

Charge Structure and Transparency

Comprehending the cost structure and ensuring openness are essential elements when evaluating an audit method. A clear and comprehensive cost structure enables clients to anticipate expenses and budget plan accordingly, lessening the capacity for misconceptions or unexpected expenditures. It is crucial to ask whether the technique uses a set cost, per hour price, or a mix of both, as this can significantly affect total costs.

Furthermore, transparency in payment techniques is important (Succentrix can help go right here you start an accounting practice). Customers must receive clear invoices detailing solutions rendered, time invested, and any type of surcharges. This level of information not only fosters depend on yet also allows clients to evaluate the worth of the services supplied

Finally, think about whether the bookkeeping technique is ready to give written agreements that outline all solutions and connected fees. This can offer as a safeguard against surprises and makes certain both parties have a good understanding of expectations. By focusing on fee framework and transparency, customers can make enlightened decisions that line up with their monetary goals.

Customer Evaluations and Reputation

Several customers discover that the track record of an accounting practice plays an essential function in their decision-making process. A well-regarded company is typically identified with integrity, expertise, and competence. Customers typically look for evaluations and endorsements to determine the experiences of others, which can significantly affect their selection of audit solution.

Furthermore, it is suggested to investigate the method's record relative to conformity and moral standards. A company that has actually dealt with disciplinary actions might position a risk to your financial honesty.

Conclusion

In verdict, choosing a proper accounting method demands careful analysis of numerous directory vital elements. Thorough study right into client evaluations and the firm's total reputation gives valuable insights right into reliability and professionalism and trust, ensuring informed decision-making.

Report this page